Talent Risk Management Step One: Assess the Business

Talent risk is business risk, which is why i4cp set out to examine how the best companies in the world are managing—and mitigating—it. The first step, one of four outlined in a model you can read in the complimentary research report Talent Risk Management, is assessing the talent risk facing your organization.

The following is an excerpt from that report:

The process of managing talent risk—be it organizational or individual—begins with assessment of the business need for specific talent. Sometimes this need is sudden and urgent, with immediate consequences if proper and effective action isn’t taken; other times the need unfolds over time in ongoing conversations and analysis by human resources professionals with executives, business unit leaders, and line managers.

For example, at Fluor Corporation, a multinational engineering and construction firm that employs 60,000 people and is well-known for having robust career development strategies for its high performers, attention to individual talent risk is driven by one of the company’s biggest talent risks—competitors coming after their best people.

“If they are hunting for great project talent they know that Fluor is the place to look,” explains Glenn Gilkey, former EVP of HR (Gilkey retired in 2016). This means that the company must work even harder to treat their employees well and to hold managers accountable for developing them if they don’t want them to leave. The approach at Fluor is to ensure that high-potential employees know that their work is recognized and valued and that someone is actively invested in helping them build their career, Gilkey says.

On the other hand, for Toyota Financial Services, the need for managing talent risk became a high priority when Toyota announced its plans to relocate to Plano, TX. “The move was the catalyst that pushed the HR department to connect talent planning and analytics with talent management in a way that would allow the HR department to finally deliver integrated talent management to the business,” explains Toyota’s Stephanie Glassburn, who works in the strategic workforce planning function.

“We faced many questions about what the transition was going to mean to our business, and above all, how we ensure business continuity, and reduce some of the uncertainty about the move,” added Monica Sarratt, who also works in the strategic workforce planning function. Risk assessment can thus play a powerful role in shaping risk management strategies, and typically encompass such areas as:

- Reviewing business strategy with operational leaders

- Using workforce financial data (headcount, total cost of workforce)

- Conducting external labor market scans

- Conducting supply demand analysis

Globalization: Assessing an increasing business risk

Many organizations lack the immediate and burning business platform that propelled Toyota Financial Services to talent risk maturity. However, a move into new markets can prove an equally compelling driver, as can the need to assess risk of managing talent in multiple geographies.

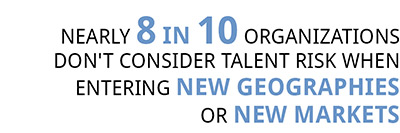

Recent research has found that a third of CEOs report that their companies have entered new industries in the last three years, and more than half (56%) believe that organizations will increasingly compete in new sectors in the next three years, which means competition for talent will only get more intense (McCarthy, 2015). Clearly, the need for talent risk management is escalating quickly. Yet, while i4cp research shows that considering talent risk upon entering a new geography or a new market has positive correlation to market performance, nearly eight in ten survey respondents indicate their organizations typically do not make either consideration a high priority.

Recent research has found that a third of CEOs report that their companies have entered new industries in the last three years, and more than half (56%) believe that organizations will increasingly compete in new sectors in the next three years, which means competition for talent will only get more intense (McCarthy, 2015). Clearly, the need for talent risk management is escalating quickly. Yet, while i4cp research shows that considering talent risk upon entering a new geography or a new market has positive correlation to market performance, nearly eight in ten survey respondents indicate their organizations typically do not make either consideration a high priority.

By conducting external market scans, an organization is better able to ascertain the supply and demographics of qualified people in a region the company plans to expand operations in the next two years. This information, coupled with an internal supply/demand analysis, helps the company understand not only the gap that may exist between its forecasted need and its ability to meet that need from its existing talent pool, but also its prospect of meeting that demand from the overall talent pool in that region.

Take, for example, a company that has plans to significantly expand its customer footprint in Latin America. The company, which is headquartered in the northeast United States, has an abundant supply of candidates (internal and external) who may be familiar with the customers in the northeast U.S. and have demonstrated track records managing similar sales territories in other areas of the U.S. However, that same company may have only one person who has both the demonstrated track record for managing sales as well as knowledge of the language(s), cultures, and customer base across Latin America. Herein lies a major talent risk for this company.

The results from this talent risk analysis should direct and prioritize the appropriate talent management initiatives to mitigate this risk. Of course, this will elicit action to ensure the current sales manager in Latin America is retained and engaged. However, the company should also consider its talent brand/employer brand—how is it perceived by current and prospect employees and what can be done to strengthen it? What about from a knowledge transfer perspective?

i4cp research on talent mobility has revealed how high-performance organizations use the movement of top talent as a means to mitigate risk by strategically moving top talent across business units, geographies, and even with external stakeholders (e.g., customers, suppliers or other key partners) (i4cp, 2016a). This aids in building the knowledge of those who are moved and also serves to expose others to important tacit or implicit knowledge otherwise known by an isolated person or group of people in a specific area. This movement of top talent can also aid in the engagement and retention of top talent.