Data Shows Employers Are Ignoring Employee Financial Health

Despite widespread public concern about rampant inflation, soaring prices, and fears of a recession, many employers aren’t assessing or investing in the financial well-being of their workforces.

Data from leading human capital research firm i4cp shows that only 12% of survey respondents—primarily HR leaders representing large companies—say that their employees have a high level of financial well-being.

However, fewer than a third of companies are prioritizing support for employee financial health. In fact, it’s more likely that organizations aren’t doing so. More business leaders (36%) said their organizations are not investing in employees’ financial well-being at all or only to a low extent.

Why?

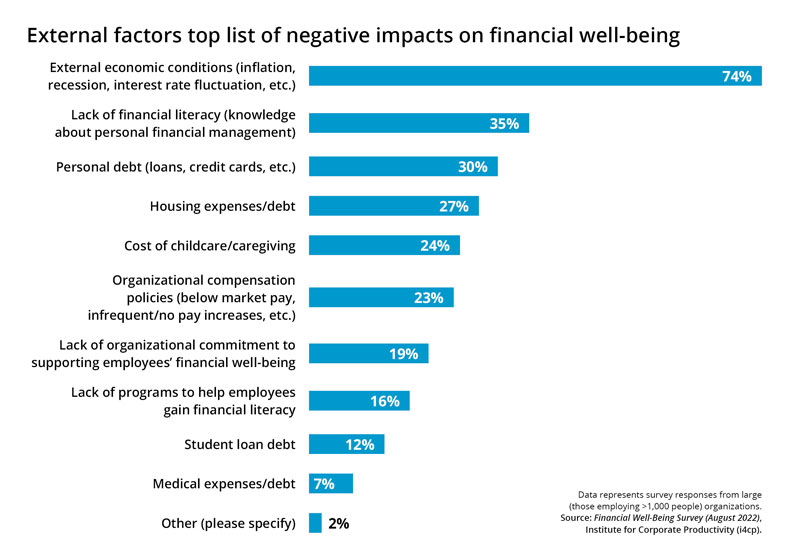

Nearly three-quarters of survey respondents (74%) cited external economic factors as creating the greatest negative impact on employees’ financial health, yet only 23% blame their own compensation policies, such as the failure of wages to keep pace with inflation and below-market pay levels.

Financial well-being one aspect of a broader approach

Financial well-being is one of six elements that figure into our holistic well-being model, as outlined in the popular report Next Practices in Holistic Well-Being. The model looks at six interconnected aspects of individuals’ overall wellness:

- Physical health

- Mental / emotional health

- Financial health (managing personal finances, salary, savings, mortgages, etc.)

- Social / relational health (connectedness to others at or outside of work—family, friends, colleagues, groups)

- Career health (job satisfaction, advancement opportunities, development, etc.)

- Community health (connectedness to communities in which one works / lives, volunteerism, philanthropy, etc.)

Not surprisingly, workforce mental health has become a top priority for employers since the onset of the pandemic. At the same time, financial well-being has lost traction, ranking fourth among the six well-being elements.

“If financial health isn’t already part of your organization’s well-being model, add it—and make a genuine commitment to support it. We found strong correlations to market performance associated with investment in each of the six elements of well-being,” states Carol Morrison, senior research analyst at i4cp and research lead for the firm’s Total Rewards Leader Board and its Employee Well-Being Exchange (both are working groups for senior professionals). “The data confirms that there’s a business case for a holistic approach and for greater focus on financial well-being.”

More employee well-being research

i4cp members: read the full Employee Financial Well-Being Brief for more detail on how employers are prioritizing and investing in employee well-being, recommendations to address financial well-being concerns, and additional insights from Carol Morrison.

Not a member?

Learn more about enterprise membership benefits for your HR team and contact us to get started.